Hapag-Lloyd’s departure shakes-up THE Alliance

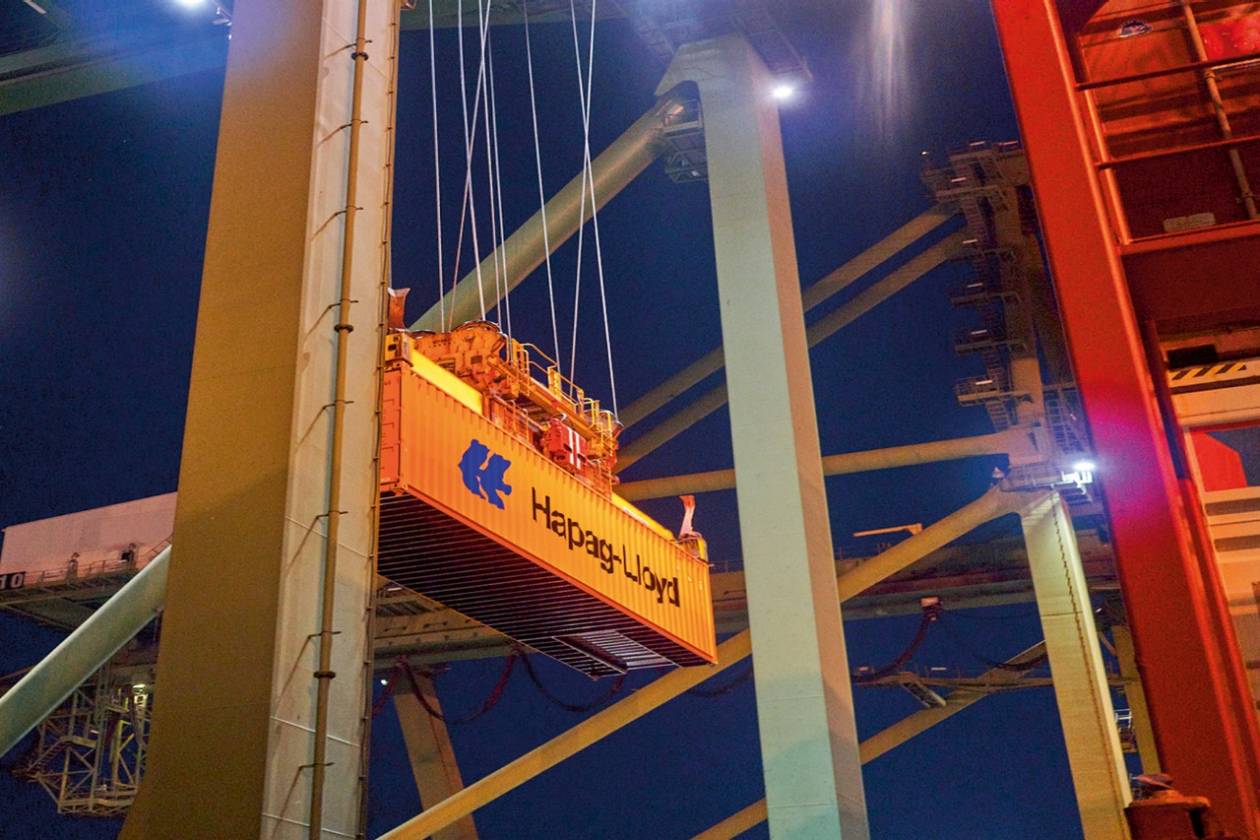

Shipping pundits are expecting liner alliances to be redrawn, after Maersk Line and Hapag-Lloyd announced on 17 January that they will form Gemini Cooperation in February 2025.

Maersk Line’s tie-up with Hapag-Lloyd coincides with the ending of the Danish giant’s 2M alliance with MSC in January 2025. Thereafter, Hapag-Lloyd will leave THE Alliance, which also comprises HMM, Ocean Network Express (ONE) and Yang Ming.

Simon Sundboell, founder of consultancy eeSea, opined in a LinkedIn post that Hapag-Lloyd, whose capacity is nearly 1.98 million TEUs, is the largest of THE Alliance's members, and the grouping will not survive without it.

Hapag-Lloyd’s departure means THE Alliance will be left with around 3.3 million TEUs, while Gemini Cooperation will be slightly ahead, with 3.4 million TEUs. Ocean Alliance, made up of CMA CGM, COSCO Shipping Lines and Evergreen Marine Corporation, will be the largest grouping, with over 8.3 million TEUs.

It is likely that the alliance will be scrambling to get new members.

Sundboell noted, “ONE, HMM and Yang Ming are scrambling right now. There's got to be frantic phone calls between Singapore, Seoul and Taipei as we speak!

“Even CMA CGM and Cosco will be looking over their shoulders in OCEAN; do they want to snap up the remaining THE Alliance carriers, and if so what's 'the price'? Or are we looking at a break-up of OCEAN, too (less likely, but possible)? Will we see a two-alliance world, with MSC on the side? Will this spur another round of M&A activity?”

Hapag-Lloyd CEO Rolf Habben Jansen said that “insufficient progress” on reliability was one factor in the German operator’s decision to quit THE Alliance. The Gemini partners aim to achieve a reliability of 90%.

Separately, Yang Ming's ex-chairman Bronson Hsieh was quoted in the Taiwanese media that Maersk Line and Hapag-Lloyd are culturally and commercially compatible partners.

Hsieh observed, “They’re very ahead of the curve in terms of environmental protection concepts, and both companies have built many dual-fuelled ships. It’s ideal for them to walk together.”

Hsieh stated that operators of a substantial scale will be welcome in any alliance.

In his memoirs, Hsieh recounted that while he headed Yang Ming, HMM was welcomed to THE Alliance after the South Korean flagship operator expanded its fleet. On the contrary, HMM was orphaned when it fell into a liquidity crisis in 2016, as it was left without an alliance partner when the Grand and New World alliances combined to form THE Alliance.

Source: Container News