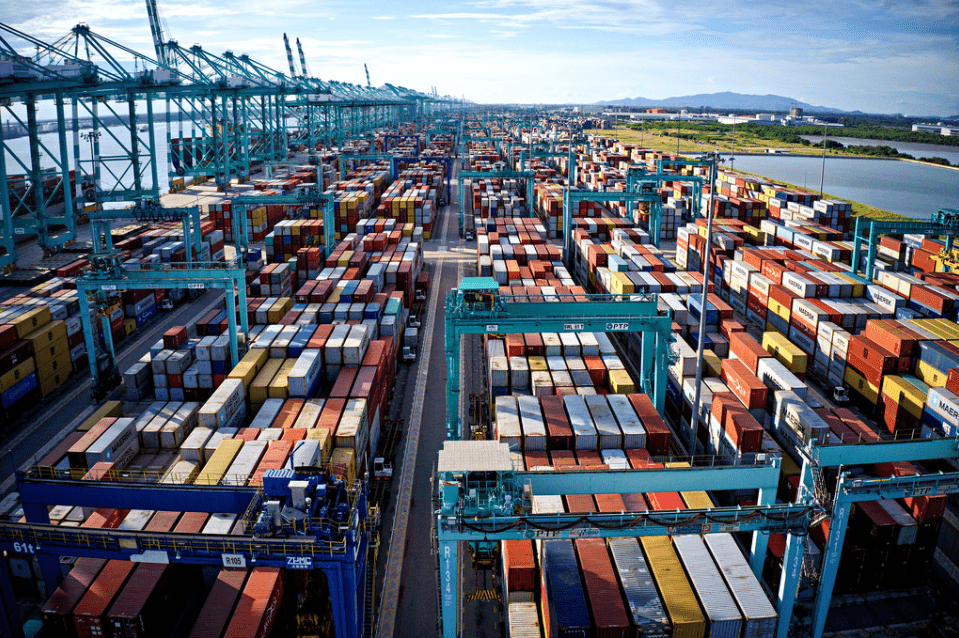

Top 10: The busiest container port and terminal operators in the world

Top 10 series of articles and this time we have noted the ten busiest container port and terminal operators in the world, according to 2020 figures.

1. PSA International - 61 million TEU in 2020 (+1% compared to 2019)

The world's busiest terminal operator, PSA International encompasses a global network of over 50 locations in 26 countries with a staff of 40,000 members, owning more than 60 deepsea, rail and inland terminals, as well as affiliated businesses in distriparks, warehouses and marine services around the world.

In the 1970s, PSA took the crucial step of building a container port in Singapore, and handled its first container ship in 1972. Ten years later, the number of containers handled crossed the one-million-TEU mark. By 1990, container volumes handled by PSA Singapore Terminals grew to 5 million TEU making Singapore the world’s largest container port.

PSA took the first step in becoming a global terminal operator in 1996 when it embarked on its first overseas venture in Dalian, China.

2. COSCO SHIPPING Ports (CSP) - 48 million TEU in 2020 ( -1% compared to 2019)

The second-busiest terminal operator in the world is a subsidiary of the Chinese shipping giant, COSCO, and is headquartered in Hong Kong.

CSP's terminals portfolio covers major port regions in Mainland China, Southeast Asia, the Middle East, Europe, South America and the Mediterranean. As of 30 June 2021, CSP operated and managed 357 berths at 36 ports globally, of which 210 were for containers, with an annual handling capacity of approximately 118 million TEU.

3. APM Terminals - 44.9 million TEU in 2021 (-4% compared to 2019)

APM Terminals is an international container terminal operating company headquartered in Hague, Netherlands. It is currently the third-busiest port and terminal operator in the world and is a part of the Danish shipping organisation, A.P. Moller Maersk.

APM Terminals operates in 42 countries with 75 ports and terminals, while in 2020 it handled more than 32,000 vessel calls and 11.2 million moves.

Maersk's subsidiary, which has 22,000 employees around the world, has reported revenue of US$3.2 billion and earnings before interest, taxes, depreciation, and amortisation (EBITDA) of US$989 million in the previous year.

4. China Merchants Group - 44.4 million TEU in 2020 - (+7% compared to 2019)

China Merchants Group was founded in 1872 and is an international state-owned corporation of the People's Republic of China, as the company is operating under the direct supervision of the State-owned Assets Supervision and Administration Commission of the State Council (SASAC).

China Merchants is a port investor, developer and operator, while it has established a relatively comprehensive port network in China's major coastal hub ports, with strong presence in Hong Kong, Taiwan, Shenzhen, Ningbo, Shanghai, Qingdao, Tianjin, Dalian, Yingkou, Zhangzhou, Zhanjiang and Shantou, as well as in Southeast Asia, Africa, Europe, the Middle East, North America, South America and Oceania.

In 2020, China Merchants Group achieved record-high economic indicators with total assets and net profit ranking first among central state-owned enterprises.

5. DP World - 44.3 million TEU in 2020 (No change compared to 2019)

United Arab Emirates (UAE) - based DP World is the fifth busiest container port and terminal operator, which expands to more than 180 countries worldwide with a team of over 56,000 employees.

Beginning operations in 1972 at Port Rashid in Dubai, UAE, DP World's activities now include ports and terminals, industrial parks, logistics and economic zones, maritime services and marinas.

DP World reported revenue of U$8.5 billion and EBITDA of US$3.3 billion in 2020, while in the last months the company has focussed on an acquisition strategy aiming to enhance and expand its global presence.

6. Hutchison Ports - 44.3 million TEU (-3% compared to 2019)

The subsidiary of CK Hutchison Holdings Limited, shares the fifth position with DP World, while the two operators have reported the same amount of TEU for 2020.

The Hong Kong-based Hutchison Ports operates 52 ports and terminals in 26 countries in Asia, the Middle East, Africa, Europe, America and Australasia, while it occupies 30,000 employees worldwide.

The Group's journey dates back to 1866 when the Hong Kong and Whampoa Dock Company started by constructing and repairing ships which later, in 1969, diversified into cargo and container handling as Hongkong International Terminals Limited (Hutchison Ports HIT).

In 1994, the Group was renamed at the current name while its network was expanded with logistics and transportation businesses such as cruise ship terminals, distribution centres, rail services and ship repair.

7. Terminal Investment Limited (TIL) - 28.2 million TEU (-2% compared to 2019)

The subsidiary company of Mediterranean Shipping Company (MSC), TIL was founded in 2010 aiming to secure berths and terminal capacity in the ports used by the Swiss shipping line.

TIL has become one of the most geographically diverse container terminal operators globally, by operating 40 terminals in 27 countries in Europe, Asia, North America, South America and West Africa.

8. International Container Terminal Services (ICTSI) - 10.2 million TEU in 2020 (+1% compared to 2019)

After its establishment in the Philippines in 1997, ICTSI consolidated operations at the Manila International Container Terminal and soon expanded its presence worldwide.

Now, the eighth-busiest terminal operator occupies 7,000 employees in 34 terminals across 20 countries in the Asia Pacific, America, Europe, the Middle East and Africa and innovates in its field after launching the first fully automated container handling facility at Victoria International Container Terminal in Melbourne of Australia.

Independent with no shipping or consignee-related interests, ICTSI works and transacts with all stakeholders of the supply chain.

9. CMA CGM- 8.2 million TEU in 2020 ( -1% compared to 2019)

The fully-owned CMA CGM subsidiary, CMA Terminals including APL Terminals, was created in 2012 and handled 2.6 million TEU in its first year of operations alone and therefore soon became the ninth-largest company in the industry of port operations.

Even though CMA Terminals was established by the homonymous shipping company, it serves all carriers and operates all aspects of container terminals, from conception and development to acquisition and management, in key-trade markets.

CMA CGM owns in total 48 terminals worldwide, 27 of which are operated by CMA Terminals, and 21 by Terminal Link company whose 51% is held by the CMA CGM Group and 49% by China Holdings International.

10. Evergreen Marine Corporation (EMC) - 8 million TEU in 2020 (-4% compared to 2019)

EMC is based in Taiwan and apart from being the seventh-largest container shipping line in the world, is also involved in the port/terminal operating sector.

EMC is operating three major transshipment hubs, two in Taiwan, Taichung Container Terminal and Kaohsiung Container Terminal, and one in Panama, Colon Container Terminal. Additionally, the Taiwanese firm is also active in the United States, Europe and Asia, operating several terminals, such as the Taranto container terminal in Italy and Evergreen Los Angeles Terminal in California.

Source: Container News