Demand rebound loses some steam in April, reports Sea-Intelligence

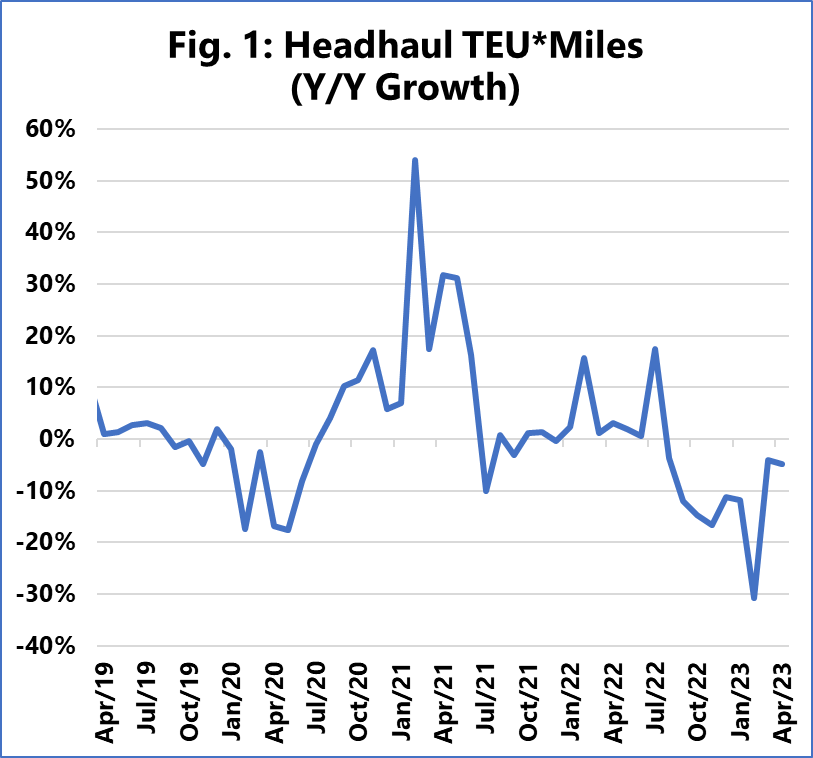

Sea-Intelligence reported that in terms of TEU*Miles (which also accounts for the distance a container has to travel), there was a sharp 6-month growth reduction that reverted to "only" a minor level of growth decline in March 2023.

"This new trend continued in April as well, albeit somewhat less strong," noted the Danish maritime data analysis firm.

Sea-Intelligence analysts explained, "When we look at a cross plot of Y/Y demand growth in April 2023 against the share of global TEU*Miles for the global trades, we see that while the Far East to North America and Far East to Europe trades are substantially larger than the rest, the low North America imports are causing the growth decline."

This is corroborated by the fact that the TEU*Miles growth minus the Far East to North America trade rebounded to positive growth in March and stayed there in April 2023 as well, according to the report.

"However, as we know, because of the trade imbalances, it is the strength of the head-haul markets which is the true measure of whether the ships are full or not,” stated Alan Murphy CEO of Sea-Intelligence.

The figure depicts the Y/Y growth in head-haul TEU*Miles. As can be observed, the market recovery deteriorates slightly again in April. Once again, this is mostly due to the continued decline in the Far East to North America volume.

"This very poor performance should furthermore be seen in the context of the inventory developments in the US we covered in issue 617 of the Sunday Spotlight. Therein, it was clear that despite the drop in imports, inventory sizes were still not declining, which remains problematic," said Alan Murphy.

In essence, Sea-Intelligence sees a picture where global demand is indeed recovering in terms of growth rates, but with the trade to North America as well as key intra-regional trades, not being a part of this recovery.

Source: Container News