CMA CGM introduces new intermodal services in Asia and Africa

The French carrier, CMA CGM has announced the launch of two new intermodal solutions in Asia and Africa.

Firstly, CMA CGM has introduced its new rail product connecting the world from/to Aswan, Egypt with a weekly train through Damietta and Ain Sokhna corridors connecting with Med Lines and Rex.

CMA CGM said that transit time inland to Aswan Ramp is three days and 6th of October Ramp one day. Additionally, Aswan is reached in 31 days from Shanghai and 6th of October in 29 days.

CMA CGM's intermodal rail solution from/to Aswan, Egypt

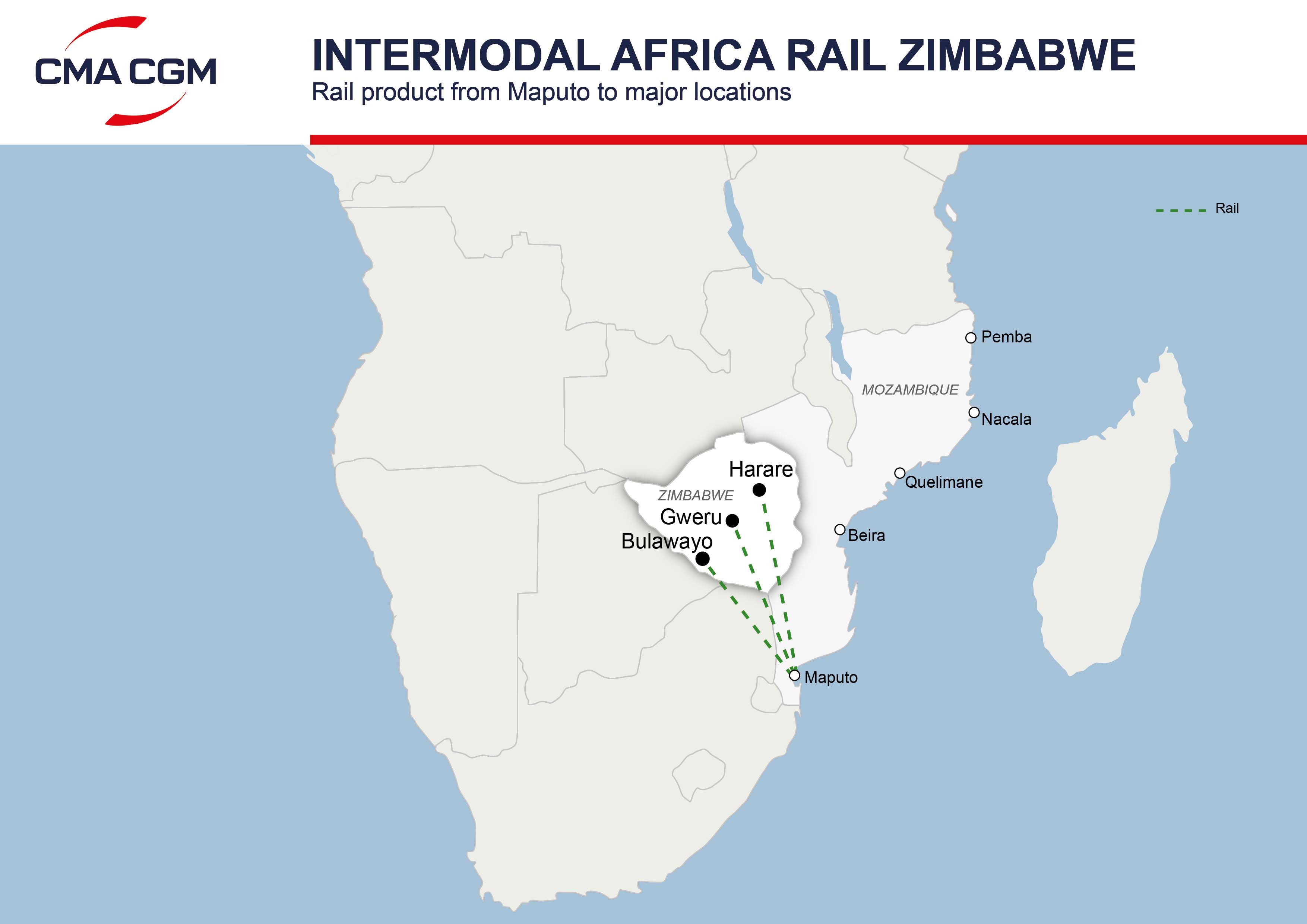

Furthermore, the Marseille-based container company has announced that in complement to its current rail service Beira, Mozambique > Harare, Zimbabwe, it will offer a new product with a weekly departure from Maputo, Mozambique on Mozex service to Ramp Harare, Bulawayo and Gweru in Zimbabwe.

The transit time inland to Zimbabwe Ramp is within five days, according to CMA CGM's announcement, while Harare, Bulawayo and Gweru are called from Shanghai in 29 days, Qingdao in 35 days and Singapore in 21 days.

CMA CGM's intermodal rail solutions in Zimbabwe from Maputo Ramp, Mozambique

Reference: Container News