Greeks and Chinese dominate global fleet market

"The global fleet of cargo carrying ships consists of around 61,000 ships with a deadweight capacity of about 2,200 million tonnes. The ships owned by Greek and Chinese shipping companies contribute 34% of the total fleet’s deadweight tonne capacity," says Niels Rasmussen, chief shipping analyst at BIMCO.

Although consolidation has been significant within the container shipping segment, the overall shipping market is still very fragmented, and the average shipping company only owns a few ships. Over time, key shipping nations have, however, emerged. Some have since lost importance due to shifts in global trade, but Greece has remained the world's foremost shipping nation.

More recently, China’s importance as a shipping nation has grown and Chinese shipowners now jointly control the world’s largest merchant fleet. The country also currently owns the second largest fleet of cargo carrying ships.

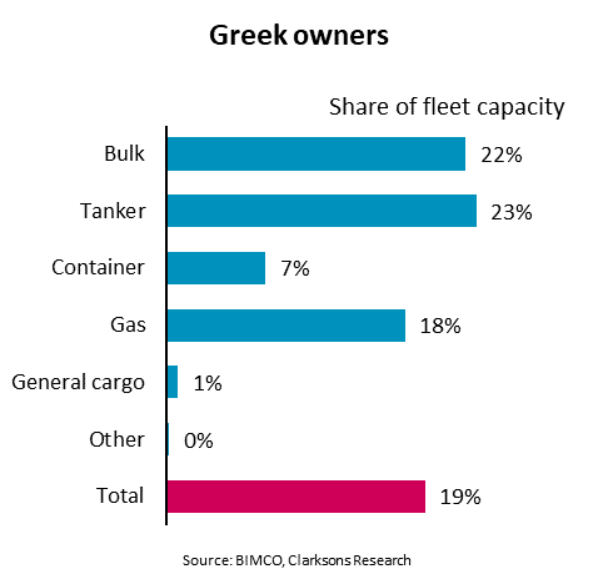

"Measured by cargo capacity, Greek shipowners control the world’s largest fleet of cargo carrying ships. In total, they control 19% of the cargo carrying capacity and maintain a particularly high share within the dry bulk, tanker, and gas carrier sectors," says Rasmussen.

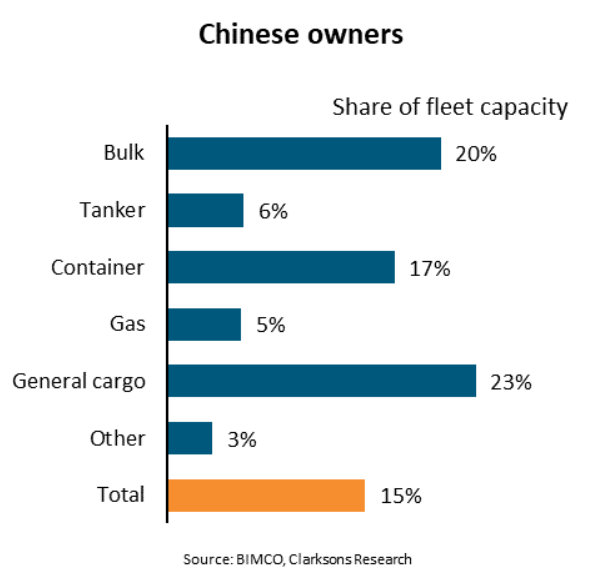

The focus of Chinese shipowners has been slightly different. They control a smaller share of tankers and gas carriers but a higher share of the general cargo and container fleets, with COSCO Shipping contributing to the higher share of the container fleet.

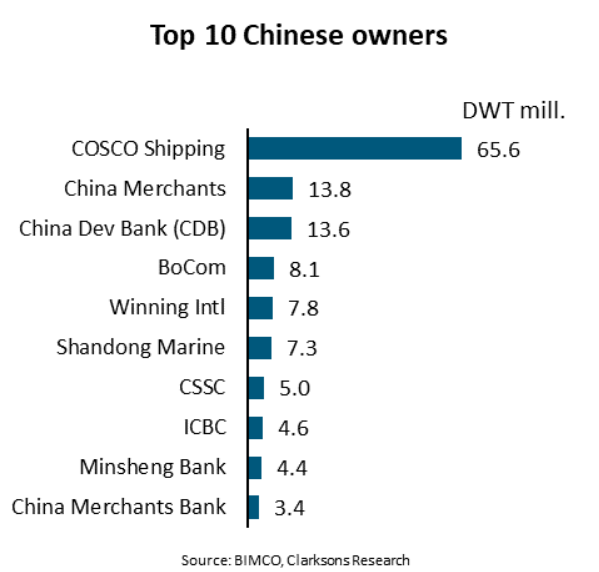

The entry of Chinese financial institutions into the leasing market has significantly contributed to the growth of the Chinese owned fleet in recent years, and five out of the 10 largest Chinese shipowners are leasing institutions. Combined, the ten largest shipowners control 41% of the Chinese owned fleet.

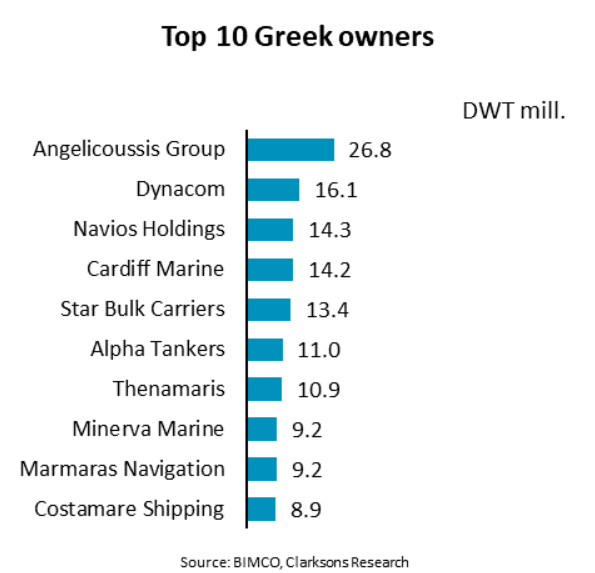

The ten largest Greek shipowners are all “traditional” shipowners. Unlike the top ten Chinese owners, the top ten list of Greek shipowners is not dominated by one large owner. Instead, there are seven owners with fleets larger than 10 million deadweight tonnes whereas only three Chinese shipowners have such large fleets.

Even though the Chinese fleet has fewer large owners, the order book held by all Chinese shipowners is 21% larger than the order book held by Greek owners.

Although Greek owners are often very active in the second-hand market, this could indicate that the Chinese fleet may grow faster than the Greeks’ fleets in the coming years.

"Common to both Chinese and Greek shipowners is that relative to their existing fleet, their order books are for LNG carriers and Pure Car Carriers (PCC), two markets currently experiencing solid growth. Chinese owners hold the largest order books in these segments. The order book for LNG and PCC ships is respectively 126% and 260% of the current fleet," says Rasmussen.

Source: Container News