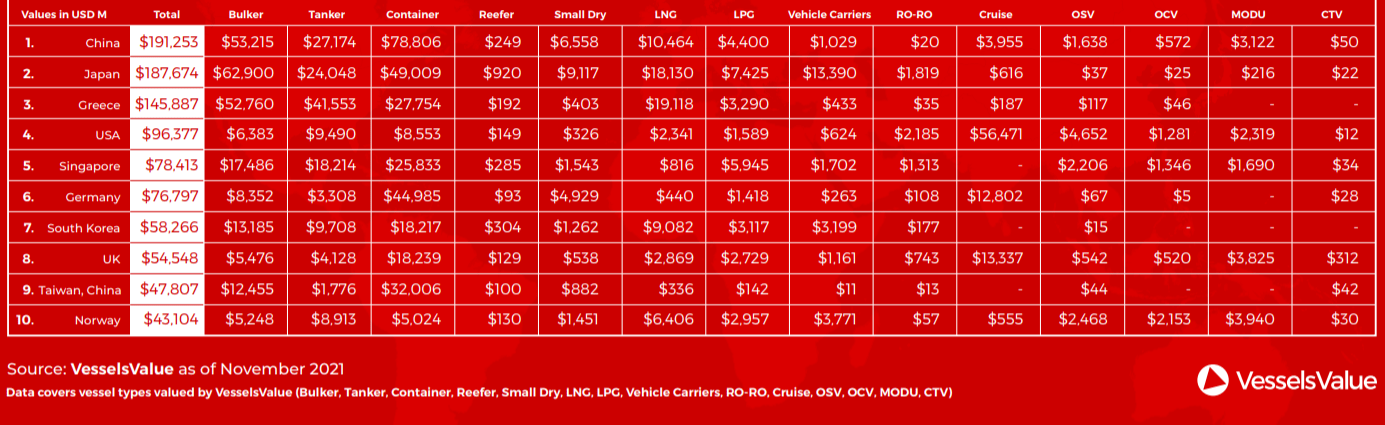

Top 10: Ship owning nations in the world

November 2021 total fleet values in the following Top 10 Ship Owning Nations list include the following vessel types: Bulker, Tanker, Container, Reefer, Small Dry, LNG, LOC, Vehicle Carriers, RoRo, Cruise, OSV, OCV, MODU and CTV.

The following list is based on VesselsValue data as of November 2021.

China

China has moved up from second in January to first place this time, owning a total of US$191 billion in assets.

China owns the largest number of container ships and, consequently, the recent surge in rates and values has moved them up the ranks to the top spot in terms of fleet value. The increase in rates has also prompted an ordering spree across the container shipping sector, as owners’ confidence in the market exploded. A total of 516 boxships have been ordered since January 2021, 46% of these orders were placed by Chinese companies including OOCL, SITC and COSCO Shipping.

We have seen a significant increase in bulker rates since the beginning of the year with the Capesize 54-TCA increasing from US$16,656/day on 1 January to a peak of US$86,953/day on 7 October, an increase of 420%. This has nearly doubled the total value of China’s bulker fleet over the past 10 months from US$28 billion to US$53 billion.

Japan

Japan has fallen from first to second place, owning a total of US$187 billion in assets. This is an increase of over US$70 billion since January 2021, highlighting the booming bulker, LPG, and vehicle carrier markets. Out of the top 10 nations, Japan owns the highest value LPG fleet at US$7.4 billion. Earnings and sales have caused an increase in the total fleet value by US$1.6 billion since January.

The total value of vehicle carriers under Japanese ownership amounts to a staggering US$13.4 billion, an increase of US$6.1 billion compared to earlier in the year. This increase has been caused by the leading Japanese companies MOL, NYK Line and K Line ordering 26 newbuilds since the beginning of the year. Japanese shipyards have raised their tariffs to US$100 million for a dual fuel LNG, 7,000 CEU vehicle carrier, up a staggering US$10 million compared to last year.

Greece

Greece has bumped its way up to third place in the rankings since January this year. Their total value increased from US$93.2 billion at the beginning of the year to US$145 billion. Greece is the largest tanker owner and although earnings have been lingering at record lows, we have seen increases to spot rates which have brought up values for the entire fleet. Newbuilding values, and hence resale values, have increased between 20-30% across VLCCs, Suezmaxes and Aframaxes since the beginning of the year.

Greece is also the owner of the most valuable LNG fleet. With current spot rates soaring, the value of their fleet has increased by US$2 billion since the beginning of the year.

Greece’s bulker fleet has almost doubled in value from US$28 billion to US$53 billion, as a result of the high rates. The Greeks remain active in the S&P market accounting for about a quarter of the bulkers bought so far this year.

United States

The United States of America has fallen to fourth place since January this year with a total of US$96 billion in assets.

US$56 billion of this comprised of cruise ships which come as no surprise as the largest cruise companies, Carnival and Royal Caribbean, are both based in the US. Despite the onslaught the industry has experienced due to the Covid-19 pandemic, the US still hold their position as the largest global cruise ship owner despite their fleet value decreasing by a total of US$7 billion since the beginning of the year.

The US is also a prominent owner in the RoRo sector owning a total of US$2.1 billion, where the market has seen an increase in value of US$1.2 billion from January.

Singapore

Singapore has remained in fifth place since January this year with similar gains in the bulker and container shipping sector as other nations. Their investments in the container sector followed the global surge, increasing their fleet value from US$10 billion to US$25 billion.

Since the beginning of the year, companies like OM Maritime and X-Press Feeders have capitalised on the roaring market and placed orders in smaller tonnages such as 2,700 and 1,800 TEU container ships.

In secondhand tonnage, one particular benchmark sale that took place was the RDO Concert (6,969TEU, Dec 2009, Hyundai HI) which was sold to OM Maritime from D Oltmann Reederei for US$110 million, the highest price paid for a 2009 built Post-Panamax container vessel since 2007.

Germany

Germany has remained in sixth place owning a total of US$76.8 billion. A large part of their fleet has always been comprised of boxships and, consequently, the huge container boom has led to the German fleet’s value rising by US$34 billion since the beginning of the year.

Their investments in the small dry sector are also being rewarded. The total fleet value has increased by US$1 billion since January as rates have increased through the year.

South Korea

South Korea moved up to seventh place since January this year, overtaking the UK. Their total fleet value now stands at US$58 billion, an increase of 24 billion since the beginning of the year.

South Korea’s investments in the LNG and LPG sectors are finally paying off with values doubling since the beginning of the year. With LNG prices peaking in the second half of 2021, the fleet values have doubled for South Korea’s gas sector. Hyundai LNG, Pan Ocean and H Line have ordered 15 Large LNG carriers this year, with the most recent order at US$200 million, an increase of US$20 million on newbuild values.

South Korea still maintains a dominant position as a global seaborne car exporter. Leading shipowners/operators are Glovis, who have expanded the PCTC fleet in recent years, and Eukor, with 20% of shares owned by Hyundai Glovis and Kia Motors. The high volume of car manufacturing and seaborne exports makes South Korea the third largest owner of Vehicle Carriers.

United Kingdom

The UK fell to eighth place owning a total of US$54 billion in assets. Their total fleet value has increased by US$15 billion since the beginning of the year with most gains seen in the booming bulker and container shipping sectors.

The boxship market has been under immense pressure over the last year; Covid-19 related pent up demand pushing consumer spending, bad weather in China and pandemic related terminal lockdowns contributing to high port congestion. However, we are now seeing global supply chain issues and port congestions threatening Christmas deliveries in parts of the UK. Felixstowe, one of the UK’s major container ports, report congestion building as a severe shortage of truck drivers means containers are piling up in port storage yards. This is making it increasingly difficult to unload and re-load vessels to be sent back to Asia. This could cause rates to increase even more across the sector and increase values further.

Taiwan

Taiwan has made a new appearance in the top 10 rankings as their investments in bulk carriers and container ships come to fruition. Their total fleet value is US$47 billion, with US$32 billion from their container fleet alone. Companies like TS Lines, Wan Hai Lines and Evergreen have placed a total of 107 orders so far this year, the 20% of the total orders placed.

Norway

Norway has fallen one more place to tenth since January this year, driven mostly by the decrease in value of the offshore fleet. A lot of Norway’s investments are in the MODU sector, so as oil majors aggressively cut CAPEX, MODU contracts are terminated, suspended, or delayed. Offshore values across all ages and types were affected. Major MODU owners such as Borr Drilling have had their fleet lose half a billion in value.

Source: Container News